Zero Brokerage on Equity Delivery! Flat ₹20 per trade for intraday, F&O & commodities. Powerful Kite platform & seamless investing.

Zerodha is India’s largest discount stock broker with 7,600,000+ active clients (2025), leading the industry with transparent pricing, robust technology, and top-rated user experience.

Open your Zerodha account and enjoy free equity delivery, advanced trading platforms, and a seamless investing experience across stocks, F&O, currencies, commodities, IPOs, and mutual funds.

Why Zerodha in 2025?

Zerodha remains the top choice for Indian investors due to zero delivery brokerage, transparent flat charges, best-in-class web/mobile platforms, and community-first innovations like Varsity and TradingQ&A.

Zerodha remains the top choice for Indian investors due to zero delivery brokerage, transparent flat charges, best-in-class web/mobile platforms, and community-first innovations like Varsity and TradingQ&A.

Zerodha Charges & Brokerage (2025)

| Account Type | Fee |

|---|---|

| Trading Account Opening | ₹200 (online) |

| Demat Account Opening | ₹100 (CDSL) |

| Demat AMC | ₹300/year |

| Segment | Brokerage |

|---|---|

| Equity Delivery | ₹0 (Free) |

| Equity Intraday | ₹20/trade or 0.03% (whichever is lower) |

| Equity F&O | ₹20/trade |

| Currency, Commodity | ₹20/trade |

| Call & Trade | ₹50/order |

| DP (Demat) Charges | ₹13.5 per scrip sell |

Hidden Charges: No hidden charges. Statutory taxes (STT, GST, SEBI, stamp duty) as per regulations.

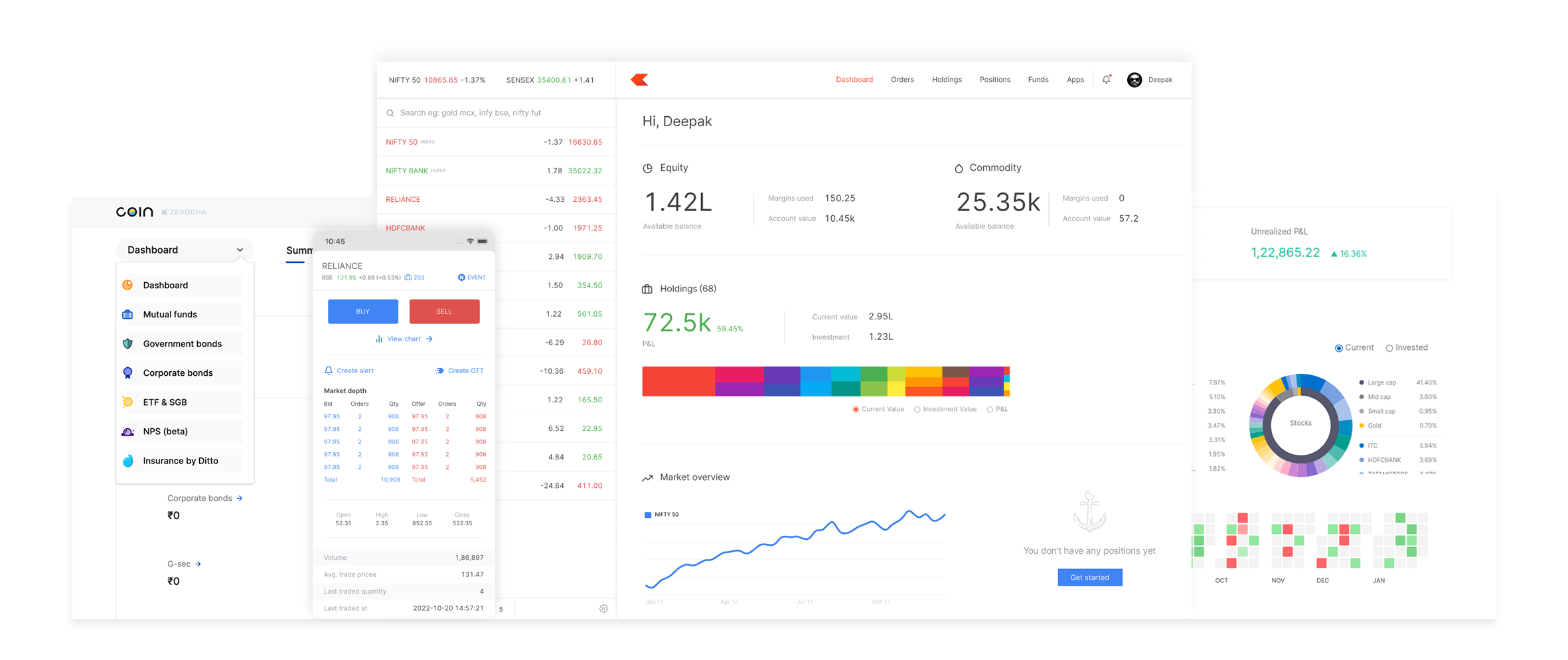

Zerodha Trading Platforms

- Kite Web: Fast, intuitive trading with advanced charts (Kite Web)

- Kite Mobile App: 4.2/5 rating, 10M+ downloads, advanced charts & order types

- Console: Back-office, portfolio analytics, P&L, tax reports

- Coin: Invest in direct mutual funds (no commission)

- Tools: Varsity (education), Sentinel (alerts), Streak (algo), Smallcase (thematic investing)

Zerodha: Pros & Cons

Advantages

- Zero brokerage on equity delivery

- Flat ₹20 per executed order for all segments

- Top-rated Kite Web & Mobile platforms

- Transparent pricing, no hidden fees

- Strong investor education (Varsity, TradingQ&A)

Limitations

- No advisory, stock tips, or RM

- No 3-in-1 account

- No margin funding for delivery

- Call & trade is costly (₹50/order)

- No direct branch support

Zerodha Margin & Leverage

| Segment | Margin Requirement | Max Leverage |

|---|---|---|

| Equity Delivery | 100% of trade value | 1x |

| Equity Intraday | Up to 20% of trade value | 5x |

| F&O (All) | 100% NRML margin | 1x |

Zerodha Ratings

Average rating: 4.2/5 (Kite App, 2.6L+ reviews), 3.6/5 (Trustpilot)

Service Quality & Complaints

Zerodha maintains a transparent complaint record with very low ratios among top brokers. Most issues are resolved rapidly via their digital support portal.

| Exchange | Year | Clients | Complaints | Ratio (%) |

|---|---|---|---|---|

| NSE | 2025-26 | 7,600,000 | 84 | 0.0011% |

| BSE | 2024-25 | 2,900,000 | 21 | 0.0007% |

| NSE | 2024-25 | 7,500,000 | 179 | 0.0024% |

| BSE | 2023-24 | 2,200,000 | 35 | 0.0016% |

| NSE | 2023-24 | 6,800,000 | 266 | 0.0039% |

Frequently Asked Questions

Is Zerodha safe?

Yes, Zerodha is SEBI-registered, a member of NSE, BSE, MCX, and CDSL/NSDL. Funds and stocks are always in your name.

What are Zerodha brokerage charges?

Equity delivery is free; all other segments are ₹20/order or less. No hidden fees.

Is the Zerodha Kite app good?

Yes, Kite app is fast, reliable, and highly rated (4.2/5), with advanced charts and order features.

Can you apply for IPO through Zerodha?

Yes, apply online using UPI via Zerodha Console.

How to contact Zerodha support?

Via support.zerodha.com, email, or phone callback. No branch or live chat support.

Does Zerodha offer margin funding?

No, margin funding is not available for delivery trades. Intraday leverage as per exchange norms.